- Home

- About

- Insurance

- Quote

- Dental/Health

- Service

- Notary

- News

- Referral Partners

- Agent Resources

Interested in Carriers?

Get automatic alerts for this topic.

[ad_1]

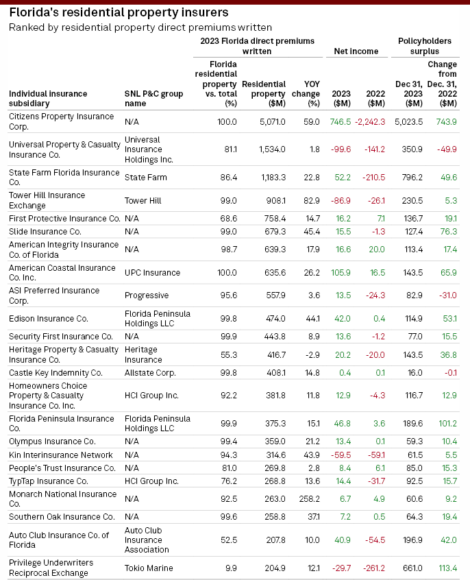

Florida’s beleaguered property insurance market is starting to look normal again, with the top insurers in the state showing a collective profit for the first time in seven years, S&P Global Market Intelligence reported this week.

The turnaround for 2023 was due in part to heightened investment income, along with improved underwriting losses aided by no major hurricane losses in the state last year, said the report by the analytics firm.

Investment income for the top 50 Florida insurers topped $346 million – more than the two previous years combined.

Investment income for the top 50 Florida insurers topped $346 million – more than the two previous years combined.

“On the underwriting side of the ledger, the industry posted collective losses of $190.8 million in 2023,” reads the report, which excluded the state-backed Citizens Property Insurance Corp. “Though that marked the eighth-straight year of underwriting losses for Florida insurers, it was considerably better than losses of almost $1.80 billion in 2022 and $1.52 billion in 2021.”

Overall, the top 50 carriers tallied $147 in net income for 2023, a far cry from the $1 billion in net losses reported in 2021 and in 2022.

The report was authored by senior research specialist Jason Woleben and is based on data reported by carriers to the National Association of Insurance Carriers and from Citizens’ market data and S&P Global’s own research.

The much-heralded legislative reforms of 2022 and 2023, which aimed to disincentive baseless claims lawsuits – shown to be a major cost driver in Florida –appear to have had an impact on insurers’ litigation costs. Direct incurred defense expenses fell to $739 million last year. While still a huge number, it’s far less than the $1.6 billion bleed seen in 2022, the report noted.

The defense and cost-containment expense ratio, considered a key measurement of the impact of litigation, fell to 3.1, down from 4.7 in 2019 and 8.4 in 2022.

But Florida, known for leading the nation in claims lawsuits, is still “far and away” producing the highest defense costs. The national median ratio is 1.2. By comparison, California-based insurers reported $402 million in litigation costs in 2023, followed by Texas, with $285 million, S&P said.

Most insurers remain optimistic about the long-term impact of the legislative reforms, though, Woleben reported.

Citizens showed continued growth in 2023, the analysis noted. But this year, Citizens’ own reports show that the insurer has slimmed down a bit, from 1.23 million policies in force at the end of last year to 1.17 million in February before climbing slightly to 1.18 million in March. Total direct premiums for Citizens climbed 53% in 2023, to more than $5 billion, the S&P report noted.

The analysis also looked at some of the numbers for individual carriers. Universal P&C Insurance Co., the second-largest property insurer in the state, reported a $99 million net loss in 2023, which was an improvement over 2022’s losses. Policyholder surplus fell by $50 million for Universal.

State Farm’s Florida subsidiary saw a $52 million profit, up from its $211 million net loss the year before. Tower Hill Exchange saw another net loss in 2023, of $87 million. That followed a $26 million loss in 2022.

Security First Insurance notched a $13.6 million profit in 2023. People’s Trust Insurance was $8.4 million in the black.

The full report can be seen here.

Topics

Florida

Carriers

Profit Loss

Get automatic alerts for this topic.

[ad_2]

Source link

Comment (0)