- Home

- About

- Insurance

- Quote

- Dental/Health

- Service

- Notary

- News

- Referral Partners

- Agent Resources

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

[ad_1]

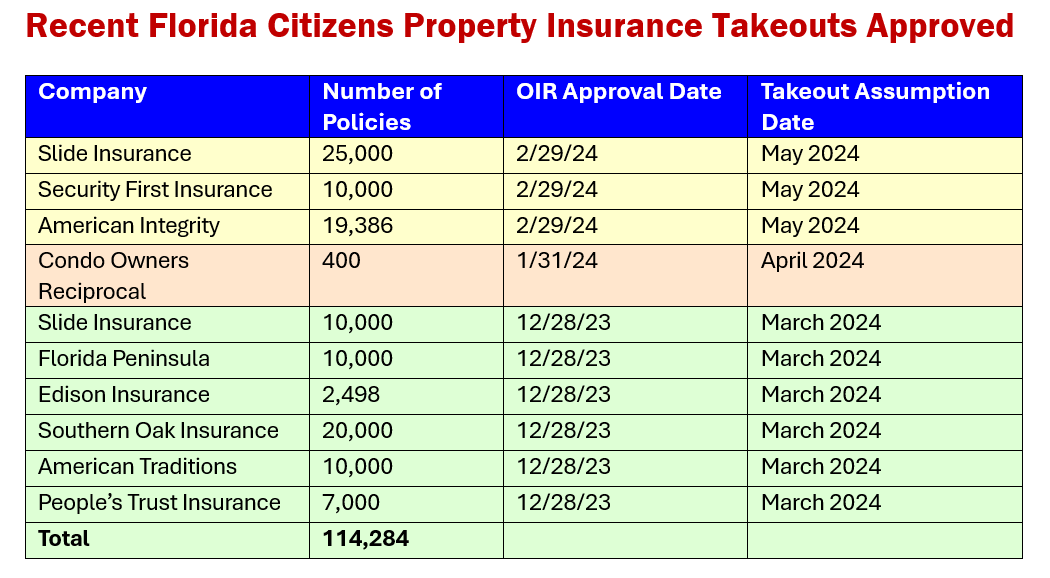

Florida’s Insurance Commissioner last week approved another round of takeouts from the state-created Citizens Property Insurance Corp., with an assumption dates in May. That brings the total takeouts with 2024 assumptions to more than 354,134, the Office of Insurance Regulation reported.

The takeouts, mostly for personal residential policies, support Citizens’ long-stated depopulation plan. As of last week, the corporation remained at more than 1.16 million policies in force, down slightly from late last year and keeping it as the largest property insurer in the state.

The number of policies actually removed from Citizens with the latest takeouts won’t be known for months. If 2023’s numbers are any indication, the number accepted by policyholders may be low. For the 646,600 takeout offers made in 2023, only about 130,400 policies were removed from Citizens – a rate of 20%, OIR reports show.

The largest share of takeout offers approved since late December were made by Slide Insurance, with 35,000 total.

“Because of the potential harmful impact to Florida policyholders, Slide shall not make takeout offers to Citizens policyholders that are more than forty percent higher than the policyholder’s estimated renewal premium with Citizens,” reads the Feb. 29 consent order for Slide’s latest offer of 25,000 residential multi-peril policies.

Slide, headed by former Heritage Insurance chief executive Bruce Lucas, must use rates that have been approved or filed under use-and-file regulations, the consent order noted. The carrier has submitted documentation showing it has secured adequate reinsurance.

More takeouts are expected later this year, particularly under legislation moving to the finish in the final days of the Florida Legislature. Senate Bill 1716 and House Bill 1503 would allow surplus lines carriers to take out policies from Citizens on second homes. The measures note that homes not occupied for nine months of the year would be eligible for surplus lines takeouts.

The bills are expected to be voted on by both chambers this week, despite concerns from some that the change would squeeze snowbirds, a major part of Florida’s economy. Surplus line are not regulated like admitted carriers, leaving those with vacation homes or seasonal residences exposed to potentially large premium increases. Claims also would have no backstop by the Florida Guaranty Insurance Association in case of surplus lines carrier insolvencies.

Citizens officials have estimated that about 77,000 policyholders could see surplus takeout offers under the bills, the Sun Sentinel newspaper reported.

Chart: Source: Florida OIR data.

Topics

Florida

Get the insurance industry’s trusted newsletter

[ad_2]

Source link

Comment (0)