- Home

- About

- Insurance

- Quote

- Dental/Health

- Service

- Notary

- News

- Referral Partners

- Agent Resources

Interested in Property Casualty?

Get automatic alerts for this topic.

[ad_1]

Allianz SE shares fell as the German insurance giant reported earnings in its property-casualty business that missed expectations.

Fourth-quarter operating profit in the segment came in at €1.6 billion ($1.7 billion), Allianz said Friday. That was below the €1.8 billion analysts had expected.

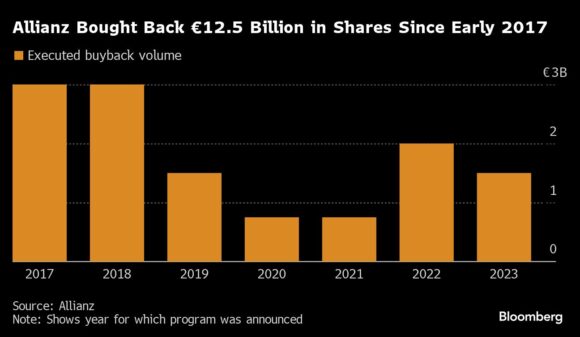

Allianz plans to kick off a new share buyback of as much as €1 billion, less than some had anticipated, and it proposed to raise the dividend by a fifth to €13.80 per share, according to an earlier statement on Thursday.

“Overall, very much a mixed bag from Allianz,” Deutsche Bank analyst Hadley Cohen wrote in a note. Allianz shares were down 2.4% at 9:57 a.m. in Frankfurt.

Chief Executive Officer Oliver Baete, who took the helm at Munich-based Allianz almost a decade ago, has made returning money to investors a priority. He has already handed shareholders about €40 billion in dividends and buybacks since early 2017, according to Bloomberg calculations.

Allianz’s fourth-quarter operating profit rose 17% to €3.77 billion on strong results from the life-health insurance business. The company targets an operating profit of between €13.8 billion and €15.8 billion this year, it also said.

The asset management unit, which includes Pacific Investment Management Co. and Allianz Global Investors, saw profit rise by 13% in the fourth quarter.

Pimco’s third-party investors pulled €3 billion in the three months through December. That put a halt to a recovery that saw clients add money in each of the first three quarters of last year after the asset manager had suffered €75 billion in outflows in 2022.

However, the US investment firm has since swung back to inflows as it pulled in about €20 billion during the first six weeks of the current year, Chief Financial Officer Claire-Marie Coste-Lepoutre said in a phone interview. The start of the year has been “absolutely stunning” for Pimco, Baete said in the same interview.

Allianz amended its dividend policy, with regular payouts increasing to 60% of net income attributable to shareholders from 50%. It aims to pay a per-share dividend of at least the same amount as the previous year, it added, after previously targeting an increase of at least 5%.

Some analysts have pointed to the possibility of Allianz moving from occasional buyback announcements throughout the year to an annual program, which could eliminate some quarterly uncertainty. The company might update investors at its capital markets day later this year.

“We would have a preference for share buybacks on a yearly basis,” Coste-Lepoutre said on Bloomberg TV.

Photograph: The offices of Allianz SE in the La Defense financial district of Paris, France, on Thursday, Oct. 7, 2021. Photo credit: Bloomberg

Copyright 2024 Bloomberg.

Topics

Property Casualty

Allianz

Get automatic alerts for this topic.

[ad_2]

Source link

Comment (0)