- Home

- About

- Insurance

- Quote

- Dental/Health

- Service

- Notary

- News

- Referral Partners

- Agent Resources

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

[ad_1]

Adam Neumann’s real estate startup Flow is planning $300 million in Miami developments in an area that was known as tent city just a decade ago.

The plans include rental apartments, retail space and small offices, all within walking distance of each other in the city’s downtown area, according to a preliminary document filed March 11 on MuniOS, an online repository for municipal offerings.

A spokeswoman for Flow confirmed that the company owns and is building the projects. They are part of the Miami Worldcenter, an urban redevelopment venture that spans more than 20 acres, multiple city blocks and several developers.

The Miami venture provides a glimpse into Neumann’s plans as he explores a joint bid with other investors for WeWork, the company he built into a $47 billion real estate giant before he was ousted and it fell into bankruptcy.

Flow, which Neumann founded after his exit from WeWork, raised $350 million from venture capital firm Andreessen Horowitz in August 2022 at a $1 billion valuation.

The office and retail space is expected to be completed by next year and the developer is “in the process of submitting an application to obtain site plan approval for its current development plan,” the municipal offering document says.

Miami Worldcenter is raising about $240 million through a municipal bond sale. The almost 800-page memorandum for the deal says that 166 2nd Financial Services, the family office of Neumann and his wife, is developing the projects. But the spokeswoman for Flow disputed that characterization.

“Any references that anyone falsely made to Adam, Rebekah or their family office are provably incorrect,” she said in a statement.

A spokesman for the Miami Worldcenter said the document would be updated to reflect Flow’s ownership of the projects. The deal is expected to price March 26, according to the investor roadshow document.

The involvement of firms linked to Neumann in Miami Worldcenter dates back to at least 2021, according to the document, with the purchase of a 44-story residential tower called the Caoba. As of December, 95% of units in the building were occupied.

Flow and developers of the original Caoba tower — Florida-based Falcone Group and Merrimac Ventures — are building another 41-story apartment tower next door. The building is expected to be completed this year, the document says.

Across the street, Flow is also planning 19,000 square feet (1,765 square meters) of retail space and 40,000 square feet of office space by 2025.

The buildings could be worth about $300 million, according to an estimate by Concord Group, a real estate consulting firm, which was included in the document.

Neumann is worth $1.7 billion, according to the Bloomberg Billionaires Index.

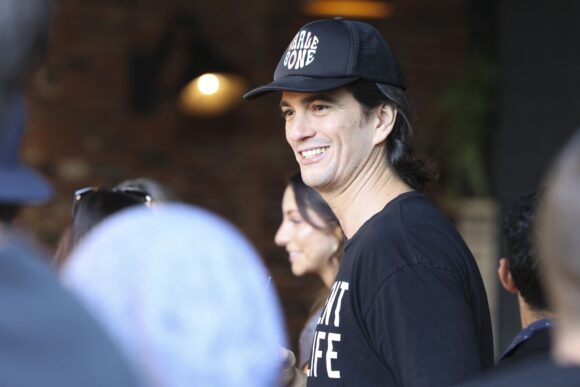

Photo: Adam Neumann (Bloomberg)

Copyright 2024 Bloomberg.

Get the insurance industry’s trusted newsletter

[ad_2]

Source link

Comment (0)