- Home

- About

- Insurance

- Quote

- Dental/Health

- Service

- Notary

- News

- Referral Partners

- Agent Resources

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

[ad_1]

The UK has the highest proportion of “fragile firms” out of all major European economies, another sign of the headwinds facing Prime Minister Rishi Sunak as he attempts to boost growth.

About 15% of small and medium-sized enterprises in the UK are at risk of defaulting on their debts over the next four years, according to research published today by Allianz Trade. That’s above France at 14%, Italy at 9% and Germany at 7%, the credit insurance firm found.

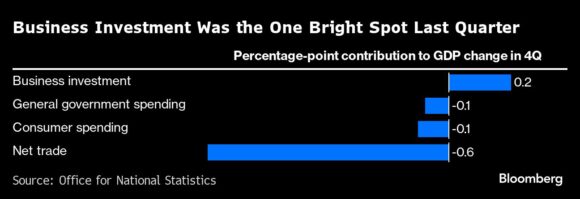

The figures follow official data showing the UK slipped into a recession at the end of last year, with many analysts expecting stagnation for the next year. Sunak, who is lagging the opposition Labour Party in polls ahead of a general election, has made economic growth one of his priorities. He’s under pressure to achieve it the goal to allow for the tax cuts the right wing of his party are calling for.

But with inflation still above target and interest rates at their highest since 2008, businesses are feeling pressure. If insolvencies continue at their current pace in higher-risk sectors such as construction, real estate, hospitality and retail, which are dependent on discretionary spending or are labor-intensive, Allianz Trade predicts more than 7,000 firms will go bust in the UK in 2024.

The global picture is grim too, the insurer said. It anticipates a 9% rise in global business insolvencies this year, following a 29% jump last year prompted by the war in Ukraine, high energy prices and the continued withdrawal of Covid pandemic-era support by many governments. For 2024, Allianz Trade thinks the largest spikes in insolvencies will be in the US, Spain and the Netherlands.

“The after-shocks economy brings a large set of headwinds and challenges,” said Aylin Somersan Coqui, chief executive officer of Allianz Trade. “These will now test the resilience of corporates that have become the most fragile over the past three years.”

In its latest Global Insolvency Outlook, Allianz Trade warned of a “five-point reality check” bearing down on businesses. That included:

Heightened fragility in companies was being caused by a multitude of factors, the report said, including rises in operating costs and a switch to “just-in-case” inventory-management strategies as more geopolitical risks emerge.

Copyright 2024 Bloomberg.

Get the insurance industry’s trusted newsletter

[ad_2]

Source link

Comment (0)